|

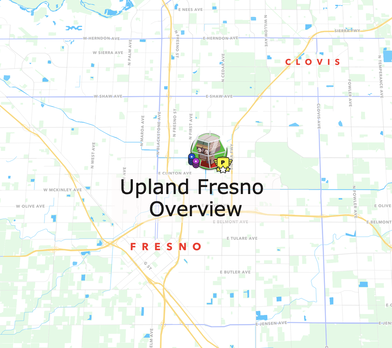

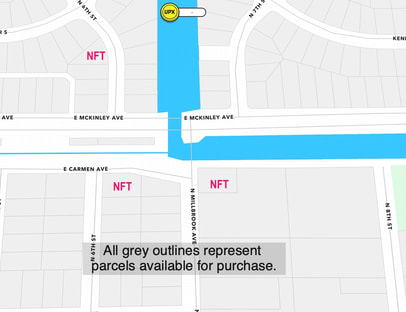

10/19/2020 0 Comments FRESNO - WELCOME NEW & CAUSAL PLAYERSThe first Upland FSA city Fresno is opening tomorrow Tuesday, Oct 20th, 2020 8AM PST. What is FSA? It stands for the Fair Start Act, by providing new/casual players to the game a sort of a head start. More about FSA here. This opening will be the first test of the FSA in action. Granting the new players an opportunity to enter into the metaverse of Upland without feeling locked out from gameplay due to the large percentage of sold properties in the bigger cities such as San Francisco and Manhattan. An opportunity to scope the game mechanics including the 10 collections available that help boost monthly earnings (yield) without spending a lot of the in-game currency called UPX. And communicate with an already amazing community Full article. This is open to new players regardless of budget. The parcels (lots) are priced according to real life economics, making Fresno a far less expensive city to purchase from than Manhattan. However, I think Fresno city opening offers something even more. An onboarding introduction to blockchain gaming (ownership) as well as, an introduction to the ecosystem of NFTs – Non-Fungible Tokens. Upland has done all the heavy lifting so you don’t have to. A blockchain wallet integrated into the game running in the background. You can still see have access to all of your transactions if you are ever that curious. Therefore, removing the barrier of adoption usually associated with blockchain technology. To signup, all that is required is a username, email address and password. Select a block explorer as your game avatar and off you go to browse the vast neighbourhoods. You will want to setup 2FA as soon as possible. Once the FSA has reached its goal and opens for everyone the only way to get there will be by train if your explorer is in San Francisco or by plane and train if you are in Manhattan. A train ride will last approximately 15mins costing 95UPX one way.

For info on Upland visit:

BEGINNERS-BLOCKCHAIN GAMING & VIRTUAL REAL ESTATE Up What? NFT (Non Fungible Tokens) Series: Upland!!! Ok I’m in Iffy about NFTs – Non-Fungible Tokens Part 2

0 Comments

10/19/2020 0 Comments Iffy about NFTs - Non Fungible Tokens Part 2 - NFTs, Collectible and Game Economy In my previous article, I outlined the basic concept around NFTs in order to help newcomers understand this emerging space. Here are four key points; 1) NFTs are non-fungible. They can’t be equally exchanged even if they look alike. Each NFT is unique. 2) There are two main categories within NFTs. There are Utility Tokens and Security Tokens. Utility tokens primarily are used for collectibles and in-game economies. Security tokens are often associated or tied to real world assets and often followed by stern regulations. See recent Youtube video from VID-T and Rolex watches. 3) NFTs are transparent. You can see transactions on what is called block explorers. 4) NFT are disrupting traditional finance. As the NFT market continues to grow and adapt, and as new participants from both categories begin to see the value of these tokens many more will join this ecosystem. In this part 2/2 article I will focus on Utility Tokens (collectibles and in-game economies) geared around the simulation property trading game Upland. If you are unfamiliar with Upland, it is a property trading game where each parcel/lot is mapped to real world addresses. As a player you use your game avatar known as Block Explorer (not to be mistaken for block explorer on the blockchain) to browse for properties you find of interest and value. Each parcel is an in-game NFT. Each marked by a unique address, border, size and value. Imagine owning a digital/virtual version of a well-known property that’s a business, landmark or a famous home. If that’s not possible then can you imagine building your very own home on top of the parcel you purchased. Design as you like (at a later date) with maybe a gallery or a garden. Then real soon, sell that home for either in-game currency called UPX or for traditional money USD. Plus, later on, you will have the ability to run your own business after you obtain a business license – of course lol. Perhaps even a business tied to a real world establishment. These are just a few ideas the Upland team is in the works of developing. But what does this have to do with NFTs? Many blockchain games use NFTs as a means of managing something like a portfolio of assets. I will use common stocks loosely as a comparison only because it is a category many people are familiar with. Say I bought a few stocks from an exchange. I have a portfolio of assets (more related to securities). They go up and down in value over time. I can sell or buy more. Each stock is unique but not transparent. There is no way for me to SEE what is going on behind the scenes. Nor can I build on top these securities and in regard to governance the option to vote is limited. In Upland, I have a few properties (in-game NFTs) that generate a percentage yield per month. A higher yield if you are the first owner or that yield radically changes if you are second or above owner. With an opportunity to increase your yield if your property is part of a collection. As the program develops, with structures and businesses, in theory so will the value of adjacent properties as well. Similar to real world real estate.  Take for example Upland’s recent Landmark auction; The Ferry building. Image courtesy of Wikipedia. This virtual parcel and structure established a closing auction price of 5,321,050UPX (US$5,321). See full article here. Now what would naturally or organically happen to the value of its surrounding lots? That means each parcel/lot could rise in value. Added structures can also assist in that appreciation. Let’s not assume this is automatic, there are and will be other factors that can and will affect value just as in the real world. Nothing is a guarantee of course, very few things are. In addition, with these NFTs is governance that is mostly guided by the community – players like me. The community also has opportunities to build and create items and content that are NFTs based to sell or market to an already established audience. Therefore, over time creating Upland player based NFTs to market and brand. So why would You want to do this? That really depends on your perspective. A traditional gamer may find it difficult to cross over to a blockchain gaming environment. As this area is geared more to a slower build vs fast and immediate action. As a player (in any blockchain game) you and you alone must obtain, search, secure and manage all your personal assets. However with strong communities there is someone available to help you get yourself established. But generally, people just want to jump in and play within an environment ready to go. That’s entirely fair. Yet, if you enjoy simulation at a moderate pace (slower than traditional games), building an environment, content creation, marketing options, teamwork and collaboration, I would suggest taking a look at Upland and the timing couldn’t be any better. Fair Start city Fresno opens tomorrow. More on that next article. Regardless if you are #babyboomer, #genxer, #gamer, #femalegamer, #artist, #coder hopefully this article has provided a glimpse into the vast world of NFTs. Other blockchain gaming projects I am involved in:

AlienWorlds: https://alienworlds.io SciFi meets real estate and crypto mining. It will be light gameplay for me as it is still too early to tell what the experience will be like. The development and releases have been well structured and controlled. More game pack releases are scheduled. One this coming Oct 23rd, 2020. Artwork is appealing and representative to genre quiet well. KOGs: https://redfoxlabs.io/how-to-play-kogs// I would try to play here and there, but primarily selected as collection. Is a project that revitalizes 90’s game brought forward into the 21st century. Fantastic artwork with interesting themes. Time will tell how the gameplay actually plays out. NFTs collectibles, more on the artistic side: Mutant Heroes: https://mutant-warriors.com A series of imaginative and colorful illustrations with their own mutant language. Dingleberries: https://twitter.com/TheDingleberri1 Well the name alone should make you wonder and chuckle. If it did it has already succeeded. Part of the reason I was interested.  NFTs - Non-Fungible Tokens. Changing the economy. Simplified. As much discussion around NFTs has increased in recent days and weeks. I thought it best to move this topic ahead of schedule. I will break away from the hype or FOMO (known in crypto lingo as Fear Of Missing Out) and focus on some of the advantages the NFT and token-economics markets provide. I am not an accountant, financial specialist or advisor. This article is my opinion and it advised that you apply caution with any monetary transaction and do your own due diligence. What are Non Fungible Tokens (NFTs)? I will attempt to simplify explanation and on why NFTs (a blockchain product) are gaining steam for the non coders/programmers such as myself. If more info on the subject check out Blockgeeks’ article. Fungibles are items that provide equal value. Ex. I can have a $5.00 dollar bill and exchange it for 5 x $1.00 dollars, 20x $0.25 cents or another $5.00. Each divisible amount still values $5.00 because a dollar is a dollar. No matter how you slice it. Non-fungible are items where the value and description of any item are different. Each item is unique and can not be ‘EQUALLY’ exchanged. Example, I can not equally (emphasis equally) exchange a loaf of bread for a can of tuna. Now before you say ‘well yes you can it’s called bartering’, I will re-affirm the word equal. You can make an exchange but it often requires both sides to agree upon the value-bargain of that exchange or swap. Maybe it is a loaf of bread for the can of tuna plus X. No matter what, the loaf of bread will NEVER equal a can of tuna. In terms of Fungible Tokens and Non-Fungible Tokens, Bitcoin is Fungible token, 1 Bitcoin is equal to 2x .5 Bitcoin (like traditional money mentioned above). Non fungible tokens are each distinctively different due to the hard coding embedded in the token, even though they may look alike. Take a look a CryptoKitties. No two kittens created on the blockchain are the same. In real life think of this example of a Granny Smith apple. On the surface they may look exactly the same, and carry very similar genetic coding, but weight is different, colour etc. Or another very common example of general knowledge are - fingerprints, snowflakes, even grains of sand. Imagine if they were to be coded on a blockchain. Let me step back a bit and explain there are at a minimum two major types of NFTs, Collectible tokens and Security tokens. The former mainly serves the collectible sector think CryptoKitties and the latter Security Tokens primarily for supply chains such as IBM. Both can offer transparency, authentication, governance, and ownership to name a few.  Investment and Speculation: Where the lines blur or do they? Again this is not financial advice. Within the digital collectibles market, there are three top subcategories, Artwork, Virtual Land and Game items. Many wonder why anyone would think to put money in a non tangible item. I explained the theory in my previous article here. The question now is are these even worthy to be seen as an investment or are they an investment on pure speculation. Example: Artwork has for many years been part of a value investment mainly for the wealthy. A hidden portfolio of wealth rarely seen by the mass population, or only seen via a trip to the museum or online content. Someone performs an appraisal of a piece of work and someone else agrees to purchase for X value. Often leaving the creator with the least amount of the pie. In the current digital space, artists (talent) are available and accessible to everyone, around the world. Everyone can purchase a piece of artwork that appeals to them. Each uniquely defined by code. And the artist can gain popularity and direct revenue. Ina very basic outlook, if I took any from category - Art, Virtual Land, Gaming as a project, and speculated on its growth how would it be different from what is already happening in the real world? In the beginning companies like IBM, Telsa, Apple, Google, GE, Amazon, eBay, all had ‘investors’ inject money speculating on the profitable gain some time in the future. The funny difference in the current speculation argument from those who are quick to dismiss the value of NFTs claim these companies had a ‘working’ business plan/model or historical successes but are also quick to forget it was still speculation - nothing was proven. Even though the number one rule is not to invest solely on historical data to predict future gains.They invested because they either liked the project (intrinsic) and/or were convinced it had future monetary value (extrinsic). The second argument is that NFTs have no utility value (extrinsic value) in the real world. Again a short sightedness. And the pandemic is proving that is incorrect. More and more NFTs are used and created to secure real world assets such as supply chain, look at Coca-Cola, medical records, Real Estate etc. You can also refer to these links from cointelegraph about Art Industry shift and Investment Companies re-evaluation of NFTs. Bright future for Artist Christies Morgan Creek Execs The true big difference here is the ‘regulation’ of the emerging blockchain technology and its sub categories. Security Tokens often would require that all investments be registered. Not the case for Utility tokens. This is the big grey, confusing, debatable area. Do NFTs pass or are under what is known as Howey’s Test? Want to know more about Howey’s Test? Check this article. This is an area many regulators around the globe are scrambling to categorize without crippling the economy - where NFTs have provided a positive economic impact so far. Final thoughts. Why are NFTs becoming very popular? They can provide actual ownership, provenance and transparency but they also provide the opportunity for Consumer to become a Prosumer. An active participant and ‘direct’ supporter of projects that one likes and desires. A direct investor without the layers upon layers of bureaucracy with extremely low risk or manipulation. The other advantage to be part of projects with teams that share your values, and integrity. Reputation is value. I am not speaking about perfection but accountability and responsibility vs the lip service often written from many corporations where actions are less than admirable - see recent JP Morgan article.  Final Example to ponder. A profound cover artwork for the comic book #Spawn made by Canadian artist #Todd McFanlane. It is a cover illustrating tribute to the late Chadwick Boseman. Which one are you? A) Not interested. Don’t like comics, B) Interested only for possible monetary value, I don’t care about comics. C) Love comics don’t care about monetary value o D) Love comics and monetary value. Some will see value others will not. Some will see its significant global and community importance others will not. And if there were NFTs of similar design or theme, the response/reaction would be no different, because we see value from a personal and collective manner. There is no right or wrong answer. We operate on both intrinsic and extrinsic values to some degree on areas of interest. That should be what we must understand at the core. |

|

RSS Feed

RSS Feed